In recent years, the landscape of corporate responsibility has undergone a remarkable transformation. Environmental, Social, and Governance (ESG) factors have transcended their niche status and become a fundamental consideration for governments and businesses across the globe. This shift is driven by evolving societal values, a growing awareness of ESG issues, and the tightening grip of regulatory measures. In this article, we will explore the increasing significance of ESG and how its relevance is manifesting in the financial sector, with a special focus on the rising number of regulations that are reshaping corporate behavior.

Society and ESG

ESG considerations have swiftly climbed the ladder of importance in society. The perception of corporate responsibility has evolved, and businesses are no longer solely judged by their financial performance. Today, companies are expected to address a broader spectrum of concerns, ranging from environmental sustainability to ethical governance.

This shift is not limited to corporate boardrooms; it is deeply embedded in the collective consciousness of consumers, investors, and governments. People are becoming more aware of ESG-related issues, pushing companies to take actions. From carbon emissions and diversity and inclusion to responsible supply chain management, ESG has permeated every facet of business operations.

Consequently, ESG is no longer a passing trend or a checkbox exercise. Every company, regardless of size or industry, must grapple with ESG challenges and, crucially, align themselves with an ever-expanding web of regulations.

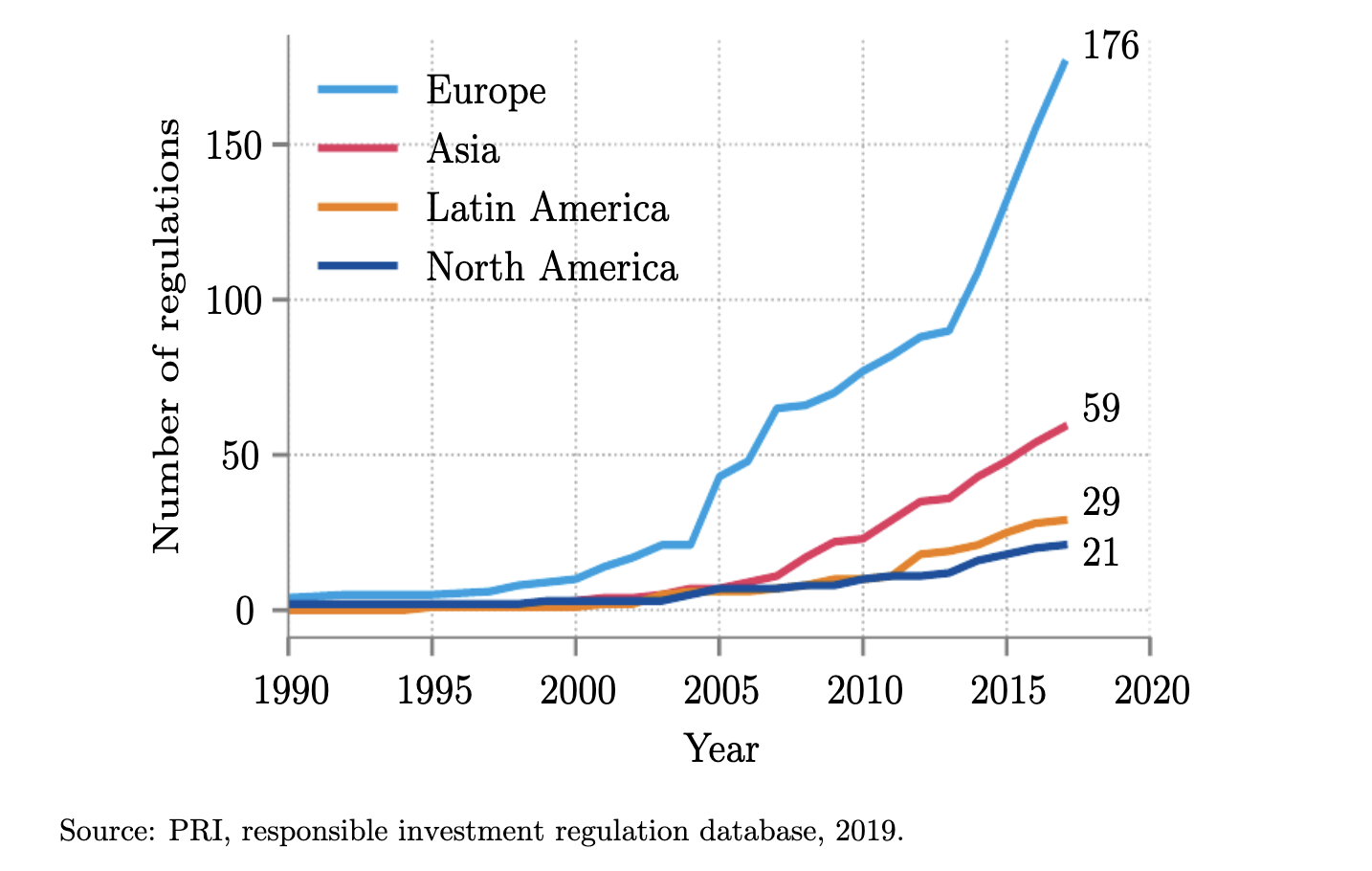

The Rise of ESG Regulations and Europe’s leading role

The rise of ESG regulations is a natural progression from the era of self-regulation, which saw many companies engaging in greenwashing, a practice where they portrayed themselves as more environmentally and socially responsible than they actually were. Self-regulation proved inadequate in ensuring meaningful change, leading governments and regulatory bodies to step in.

When it comes to ESG regulations, Europe is a trailblazer on the global stage. The European Union (EU) has taken the lead in pushing for stringent ESG standards, often followed by others. Switzerland, closely intertwined with the EU market, is significantly impacted by these regulations, as Swiss companies often need to align their practices with EU standards to maintain market access. Also, the Swiss regulations are often orientated at the ones from EU.

Some milestones are:

2014: The European Commission (EC) adopts the Directive on the Disclosure of Non-Financial and Diversity Information by Large Companies and Groups. This directive requires large companies to disclose information on their environmental, social, and employee matters.

2018: The EC adopts the Sustainable Finance Disclosure Regulation (SFDR). This regulation requires financial market participants to disclose how they integrate ESG factors into their investment decisions.

2022: The EC adopts the Corporate Sustainability Reporting Directive (CSRD). This directive requires large companies and certain financial institutions to report on their sustainability performance.

ESG and the Financial Sector

While ESG considerations have swept across all industries, the financial sector holds a unique position in the ESG landscape. The term "ESG" itself originated in the financial sector, showing the significance for this industry. Financial institutions, from banks to asset managers, have a dual responsibility: managing their own ESG performance and incorporating ESG considerations into their financial products and services.

Regulations are becoming increasingly stringent in the financial sector, where risk assessment now encompasses ESG factors. Financial institutions are under pressure to integrate ESG metrics into their investment strategies and products. The regulations represent a fundamental shift in how the financial sector operates and invests.

Conclusion: As regulations continue to evolve and grow in importance, companies in the financial sector must be prepared to navigate this complex landscape. ESG is no longer a choice but an imperative, and those who fail to adapt may find themselves struggling to meet both market and regulatory expectations in the future.